Summary

TLDR: The Bitcoin halving, reducing block rewards by half every four years, is a key feature leading to a capped supply of 21 million bitcoin. The next halving is expected around April 20, 2024. Historical halving events have led to significant price increases for bitcoin. Miners face challenges with reduced income post-halving, leading to potential bankruptcies. The halving is generally seen as a bullish event, but caution is advised in predicting price movements. Buying and holding bitcoin for the long term is recommended over trying to time the market around halving events.

Key Points

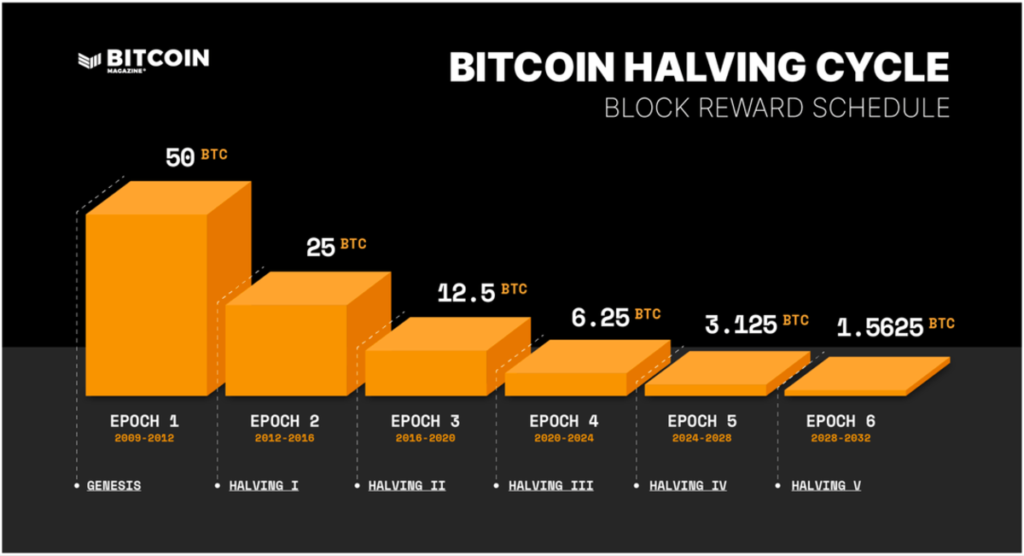

1. The Bitcoin halving is a critical event that occurs approximately every four years, where the block subsidy is halved, leading to a capped supply of 21 million bitcoin.

2. Miners also earn transaction fees in addition to the block subsidy, making the rewards for mining a block more profitable than just the subsidy.

3. Historical data shows that after each Bitcoin halving event, there has been a significant increase in the price of bitcoin due to reduced supply and increased demand.