Summary

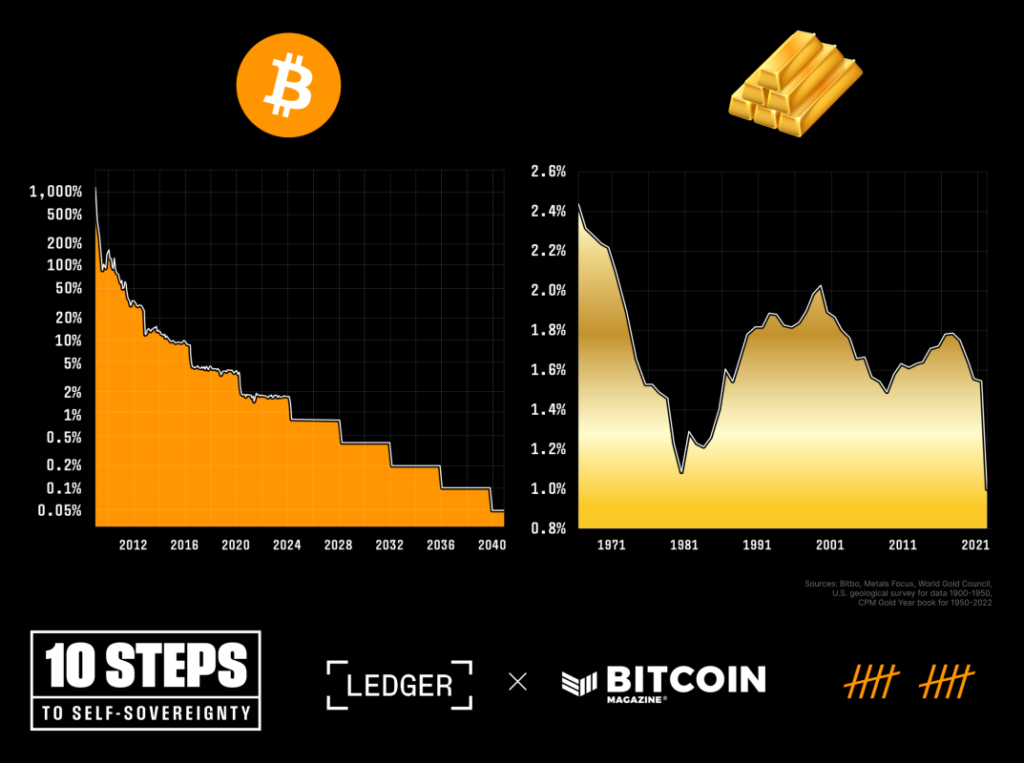

Bitcoin’s annual inflation rate will soon be lower than that of gold for the first time due to the upcoming halving event. The halving will decrease Bitcoin’s annual inflation rate from 1.7% to 0.85%. Gold’s supply is estimated to increase by 1-2% per year. Bitcoin has experienced three previous halving events, and the upcoming fourth halving is projected to occur in 2024. Bitcoin’s qualities make it a superior store of value compared to gold, with its digital scarcity, durability, and immutability. The rise of Bitcoin as a monetary good is leading to its acceptance as a store of value. The upcoming halving will likely highlight Bitcoin’s superiority over gold in terms of scarcity.

Key Points

1. Bitcoin’s annual inflation rate is set to become less than that of gold, marking a significant milestone in its store of value status.

2. Bitcoin has experienced three halving events, with the upcoming fourth halving projected to occur in 2024, further reducing the block subsidy and increasing scarcity.

3. Bitcoin’s qualities as a monetary asset, including scarcity, durability, and immutability, have contributed to its rise as a store of value, surpassing gold in certain aspects.