Summary

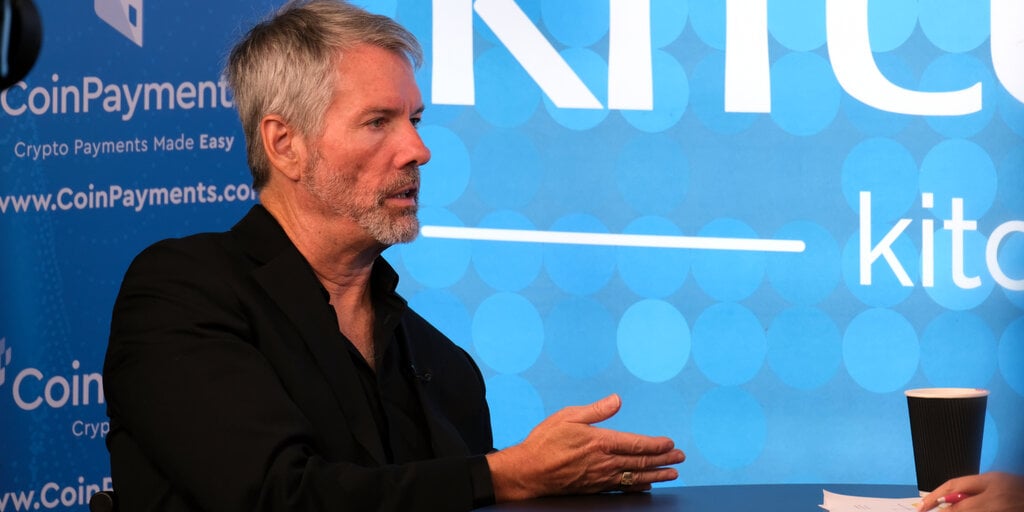

TLDR: MicroStrategy chair Michael Saylor believes that the approval of spot Bitcoin ETFs will bring institutional capital into the Bitcoin ecosystem, with demand exceeding supply. The SEC approved the ETFs, but chair Gary Gensler clarified it was not an endorsement of Bitcoin. MicroStrategy holds over 190,000 BTC and continues to buy more despite losses. Saylor sees Bitcoin as a trillion-dollar asset class competing against traditional assets like gold and real estate. He believes capital will flow into Bitcoin as it is technically superior to other asset classes.

Key Points

1. The approval of spot Bitcoin ETFs has opened the gateway for institutional capital to flow into the Bitcoin ecosystem, with demand surpassing the current supply.

2. MicroStrategy, a prominent holder of Bitcoin with over 190,000 BTC, worth around $10 billion, has been unconventional in its approach to investing in Bitcoin, with co-founder Michael Saylor selling personal stock options to buy more Bitcoin.

3. Saylor believes that Bitcoin is technically superior to traditional asset classes like gold, the S&P index, and real estate, and predicts that capital will continue to flow out of these asset classes into Bitcoin in the future.