Summary

TLDR: Proper tax planning is crucial for bitcoin investors to maximize returns and minimize tax liability. Keeping detailed records of transactions, understanding cost basis, tax loss harvesting, and strategic gifting can help optimize tax strategies. Avoiding wash sales is recommended, and utilizing Roth IRAs for tax-free growth is beneficial. Consult with a tax professional to implement the right strategies based on your situation and stay compliant with IRS regulations.

Key Points

1) Maintaining meticulous records of every bitcoin transaction and its associated cost basis is crucial, given the IRS’s authority to audit returns up to six years back. The IRS can track bitcoin transactions through KYC compliance, transaction history, reporting to the IRS, and legal precedents against major exchanges.

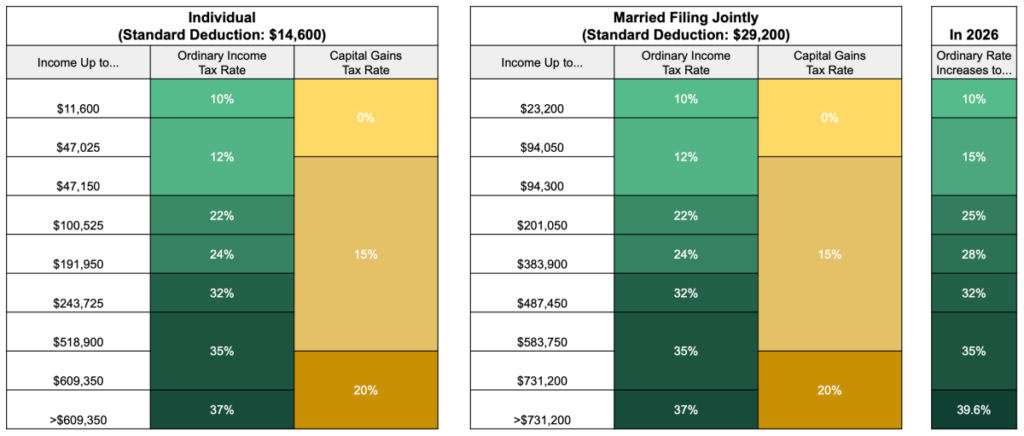

2) Understanding the different tax implications for short-term and long-term capital gains on bitcoin is essential. While short-term gains are taxed as ordinary income rates, long-term gains are taxed at rates ranging from 0% to 20% depending on income. It’s important to consider these tax tables when planning your bitcoin transactions to minimize tax liability.

3) Utilizing strategies like cost-basis tracking, tax loss harvesting, gifting, and Roth accounts can help maximize after-tax returns and minimize tax liability for bitcoin investors. Working closely with a tax professional to implement these strategies based on individual situations is crucial for long-term financial success.