Summary

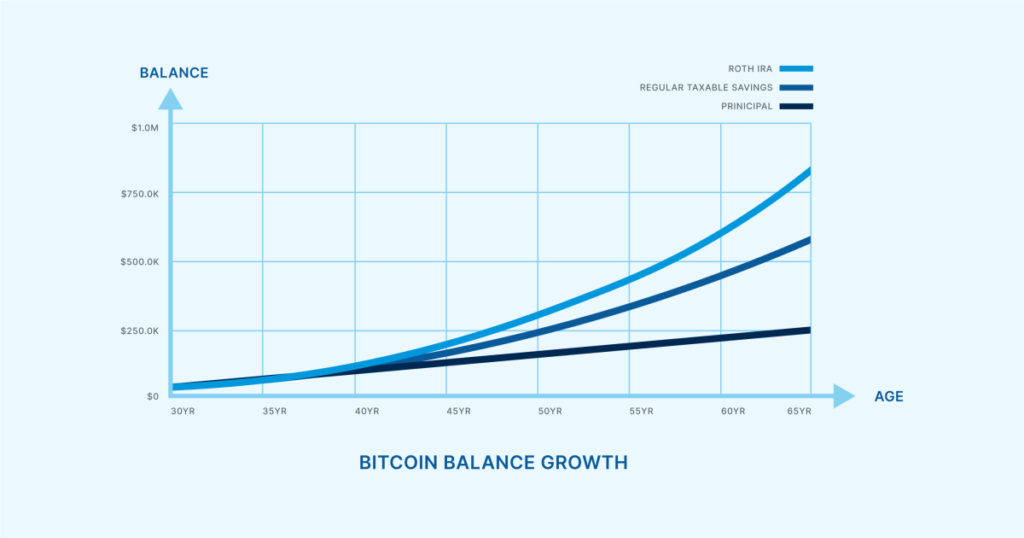

TLDR: Roth IRAs can be a valuable tool for financial goals, especially when combined with bitcoin. Case studies show how Roth IRAs can help save for retirement, optimize tax situations in retirement, and leave assets for inheritance. Factors like tax-free growth, withdrawal flexibility, and tax brackets should be considered when deciding if a bitcoin Roth IRA is right for you. It may not be suitable for everyone, so discussing with a financial expert is recommended.

Key Points

1. Sally, in her early 30s, views bitcoin as the best savings technology and is committed to a disciplined accumulation strategy for major goals like a dream vacation, a house, starting a family, and retirement.

2. Rod, preparing for retirement, strategically diversifies his tax buckets by adding a Roth IRA to pull from in high tax years and keep his bracket from climbing too quickly, optimizing his tax situation during retirement.

3. Larry, focused on leaving a legacy for his grandchildren, sets up a Roth IRA to pass down tax-free assets like bitcoin to his loved ones, allowing for long-term growth and inheritance planning.