Summary

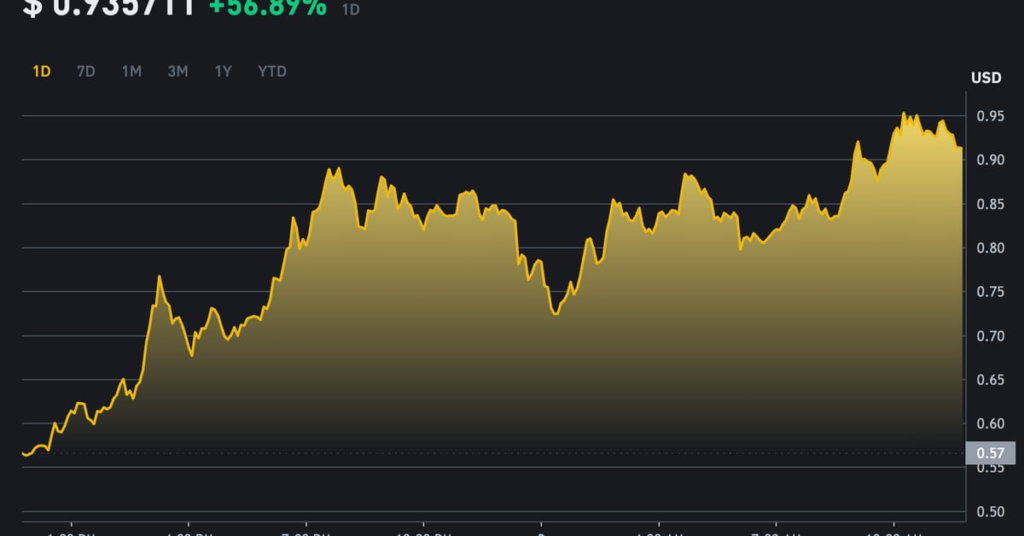

Bitcoin’s rally has slowed down, but the supply of stablecoins continues to rise, providing stability for bitcoin bulls. Bitcoin hit record highs but has struggled to maintain gains due to decreasing chances of a Fed rate cut. Stablecoin supply, dominated by USDT, USDC, and DAI, has increased by 2.1% to $141.42 billion, showing reassuring stability in the market.

Key Points

1. Bitcoin’s recent steep rally has lost impetus, struggling to maintain gains above $70,000 due to the dwindling probability of a Fed rate cut in June.

2. The supply of stablecoins, such as tether (USDT), USD Coin (USDC), and DAI (DAI), continues to rise, reaching a total of $141.42 billion, the highest since May 2022.

3. The cumulative supply of stablecoins has increased by 2.1% this year, with over $20 billion added to the market.