Summary

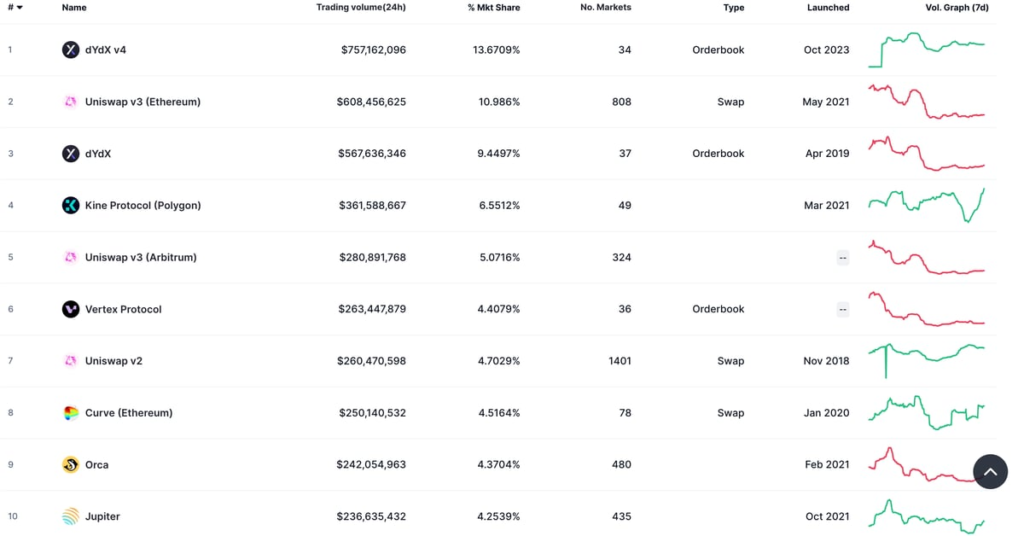

The article states that decentralized exchange (DEX) dYdX has surpassed Uniswap as the largest DEX by trading volume. dYdX saw a significant increase in trading activity due to the launch of its Layer 2 scaling solution, which reduced gas fees and improved transaction speeds. This development reflects the growing demand for DEXs and the importance of scalability in the decentralized finance (DeFi) space.

Key Points

1. dYdX has surpassed Uniswap to become the largest decentralized exchange (DEX) by trading volume. This indicates the growing popularity and adoption of dYdX among cryptocurrency traders and investors.

2. The rise of dYdX can be attributed to its unique features and offerings, such as margin trading and lending options. These features attract more sophisticated traders who are looking for advanced trading strategies and opportunities.

3. This development highlights the competitive nature of the decentralized finance (DeFi) space, with various DEX platforms vying for dominance. It also emphasizes the importance of innovation and differentiation in attracting users and capturing market share.