Summary

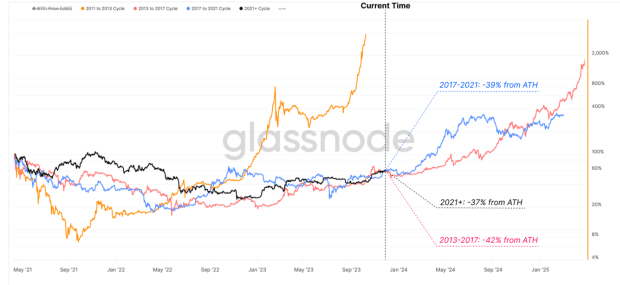

Bitcoin has experienced a significant increase in value in 2023, with a 140% leap. This surpasses traditional rivals like gold and leaves other cryptocurrencies behind. The current cycle of Bitcoin mirrors previous cycles in terms of recovery time and drawdown from all-time highs. Despite the success of Bitcoin, the number of transactions depositing funds to exchanges has hit multi-year lows. However, on-chain volume flowing in and out of exchanges has skyrocketed, suggesting increased trading and speculation. This could indicate growing institutional interest. Short-term holders of Bitcoin have been cashing in on their investments at the right time, taking advantage of the upward trend. Their activity has influenced Bitcoin’s price movement. Overall, Bitcoin’s 2023 story is full of triumphs, challenges, and excitement, with a mix of historical patterns and unpredictable market activities.

Key Points

1. Bitcoin has experienced a significant increase in value in 2023, with a growth of over 140%. This surpasses traditional rivals like gold and leaves other cryptocurrencies behind.

2. Despite the impressive performance of Bitcoin, the number of transactions depositing funds to exchanges has decreased. However, the on-chain volume flowing in and out of exchanges has skyrocketed, suggesting a shift towards non-custodial exchanges and potential growing institutional interest.

3. Short-Term Holders (STHs) have been cashing in on their Bitcoin investments at the right time, taking advantage of the upward trend. They have been moving substantial amounts of coins to exchanges, impacting Bitcoin’s price movement.