Summary

Senators Lummis and Gillibrand introduced a new stablecoin legislation bill, outlining rules for firms issuing payment stablecoins. The bill requires firms to conduct stablecoin activities through subsidiaries and places a $10 billion cap on state regulators’ ability to supervise non-depository trust companies in the stablecoin space. The legislation also prohibits the issuance of algorithmic stablecoins and requires one-to-one reserves for stablecoins. This bill follows previous crypto-related legislation efforts and aims to provide a comprehensive framework for stablecoins in the U.S. Congress is hopeful to pass the bill quickly before election season interferes with policy-making.

Key Points

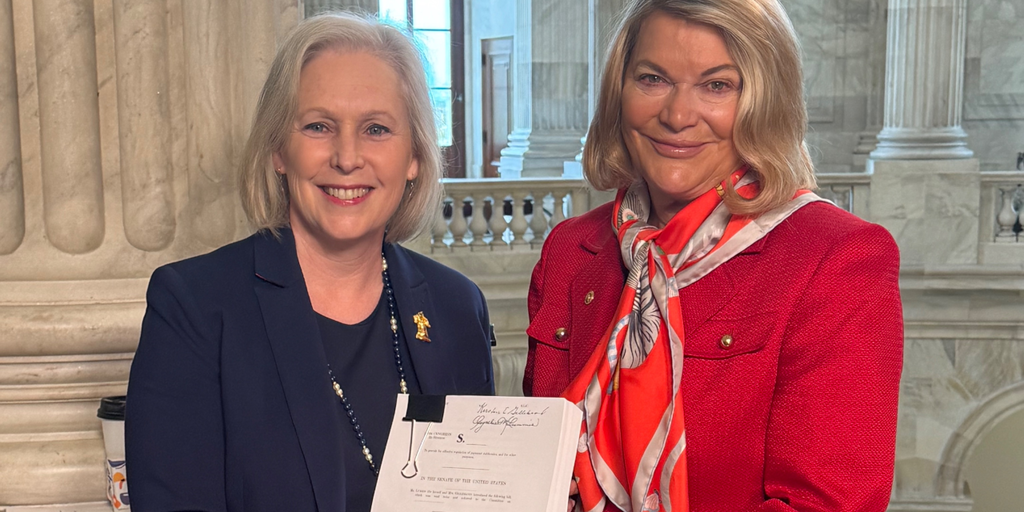

1. Senators Cynthia Lummis and Kirsten Gillibrand introduced fresh stablecoin legislation aimed at enacting a comprehensive framework for crypto assets in the United States.

2. The bill includes rules on the state and federal levels for firms issuing payment stablecoins, requiring them to conduct activities through subsidiaries. This differs from past practices by some companies like Binance.

3. The Lummis-Gillibrand Payment Stablecoin Act places a $10 billion cap on state regulators’ supervision of non-depository trust companies in the stablecoin space, aiming to bring transparency and accountability to the crypto industry.