Summary

TLDR; Bitcoin’s decentralization is a complex issue with various subsystems that play a role in measuring its level of centralization. Subsystems like mining, coding, custodial services, hardware, and ownership all contribute to the overall decentralization of the network. The limited number of core developers and the potential for interference from less benign donors pose risks to the security and stability of the Bitcoin network. Innovative solutions like micro-crowdfunding platforms and multilateral agreements among key players in the ecosystem could incentivize and support core developers to ensure the network’s long-term success. Geographical and economic decentralization are also important factors to consider in measuring Bitcoin’s decentralization. The emergence of Bitcoin ETFs in the US market could have a significant impact on the network’s decentralization, particularly in the custodial/exchanges subsystem.

Key Points

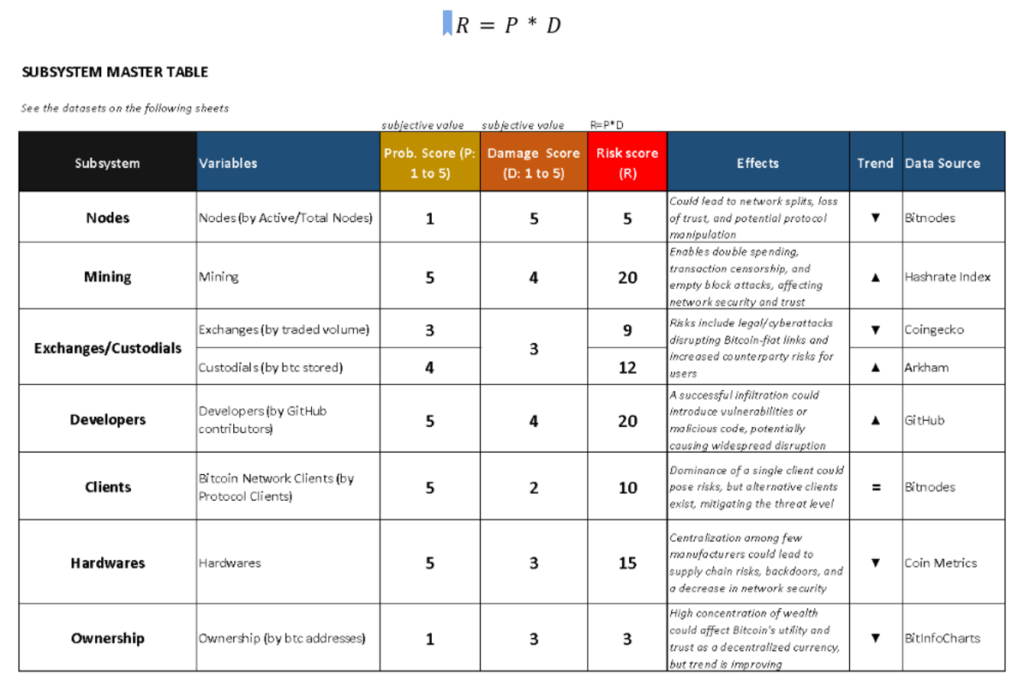

1. The concept of centralization and decentralization in the Bitcoin network is crucial to understand, as it affects the distribution of authority among participants and the potential for malicious or benign actions to influence the system.

2. The Nakamoto coefficient, introduced by Balaji S. Srinivasan and Leland Lee, provides a metric for measuring the minimum number of participants necessary to compromise or control the Bitcoin system, highlighting the risks associated with centralization in various subsystems.

3. Subsystems such as client platform, code developers, nodes, custodial/exchanges, ownership, and hashrate within the Bitcoin network play a critical role in determining the level of decentralization and vulnerability to attacks, with each subsystem posing unique challenges and risks that need to be addressed.