Summary

The Grayscale Bitcoin Trust (GBTC) has seen significant outflows since it converted from a closed-end fund to a Spot ETF. GBTC’s treasury has lost over $4 billion in the first 9 days of ETF trading, while other ETFs have seen inflows of $5.2 billion. Despite the negative price action, the net inflows into GBTC are somewhat surprising. The article provides an analysis of the causes of GBTC outflows, who the sellers are, their estimated stockpiles, and how long the outflows may continue. The projected outflows are expected to be counterintuitively bullish for bitcoin in the medium term. Overall, it is estimated that there will be a net selling pressure of 100,000 to 150,000 bitcoins resulting from GBTC outflows.

Key Points

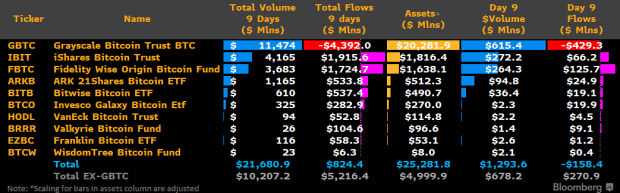

1. GBTC outflows from the Grayscale Bitcoin Trust have been significant since the approval of spot Bitcoin ETFs, with over $4 billion in outflows occurring in the first 9 days of ETF trading. Despite the negative price action, there were surprising net inflows of $824 million, indicating a potentially bullish outlook for Bitcoin in the medium-term.

2. The GBTC premium played a crucial role in driving the 2020-2021 Bitcoin bull run, but as the premium disappeared and the trust traded below NAV, a chain reaction of liquidations occurred, impacting the entire industry. Bankruptcy estates, retail brokerage accounts, retirement accounts, and institutional investors all hold GBTC shares and will likely contribute to future outflows.

3. The estimated total projected GBTC outflows could range from 250,000 to 350,000 BTC, with 100,000 to 150,000 BTC expected to be converted into cash and the remaining amount rotating into other trusts or products. This could result in a net selling pressure of 100,000 to 150,000 BTC. However, the exact impact on the market is uncertain and subject to various factors such as the price of Bitcoin and individual investors’ decisions.