Summary

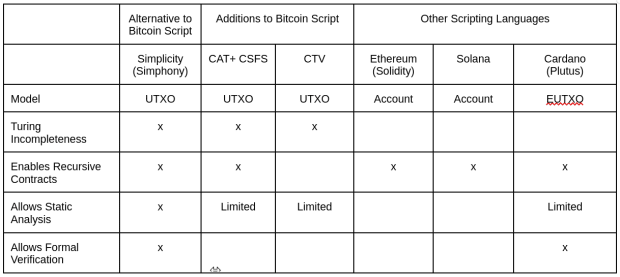

The article explores the concept of Miner Extractable Value (MEV) in blockchain networks, particularly in proof-of-work systems like Bitcoin and proof-of-stake systems like Ethereum. MEV refers to the profits that miners or validators can earn by manipulating transaction prioritization, exclusion, rearrangement, or alteration in the blocks they mine. The article examines the factors that contribute to MEV, including mempool transparency, smart contract transparency, and smart contract expressivity. It discusses the challenges and risks associated with MEV, such as front-running, sandwich trading, and arbitrage. The article also explores different proposals to enhance smart contract functionality in Bitcoin, including off-chain contracts, covenants, and the Simplicity programming language. It highlights the trade-offs and risks associated with each proposal and emphasizes the importance of prioritizing security and decentralization in blockchain networks.

Key Points

1. Miner Extractable Value (MEV) refers