Summary

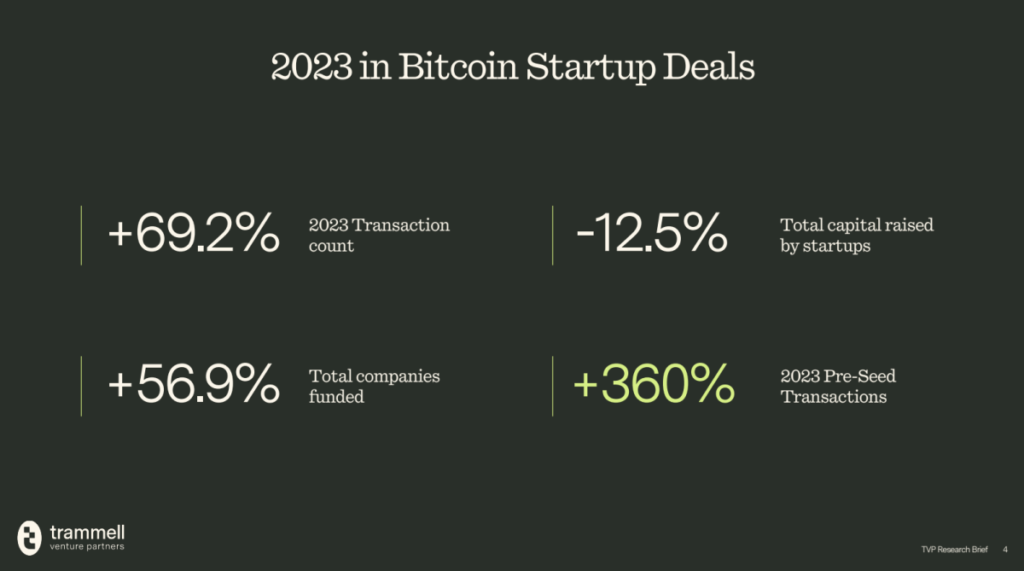

TVP’s research shows a significant increase in Bitcoin-native startup activity despite a downturn in the broader crypto venture market in 2023. Bitcoin startups saw a 69.2% growth in exit activity and collectively raised nearly $1 billion between 2021 and 2023. TVP’s findings indicate a strong desire among founders to build on Bitcoin, with increasing support infrastructure and technical advancements driving innovation. The Bitcoin-native venture deal count grew by 69.2% in 2023, and TVP believes that more allocators will see the benefits of investing in Bitcoin-native startups as the ecosystem expands. The full research brief is available for download for institutional investors interested in exploring opportunities in the Bitcoin startup sector.

Key Points

1. Despite a downturn in crypto venture market investments in 2023, there was a significant surge in the Bitcoin startup sector, particularly at the Pre-Seed stage, with a 360% year-over-year rise in transaction count.

2. Early-stage Bitcoin startups collectively raised nearly $1 billion between 2021 and 2023, marking a 69.2% increase year-over-year in exit activity and showing resilience and growth compared to the broader startup landscape.

3. TVP’s research highlights a strong desire among founders to build on Bitcoin, with increasing support infrastructure and technical advancements fueling innovation within the Bitcoin ecosystem. This is reflected in the increasing number of Bitcoin-native venture deals, which grew significantly in 2023.