Summary

Bitcoin ETFs have legitimized Bitcoin, allowing institutional investors to gain exposure without direct custodianship. The approval of ETFs has stabilized Bitcoin’s price volatility, with inflows into ETFs reducing the sell pressure from miners. As GBTC outflows decrease and inflows into Bitcoin ETFs increase, market volatility is expected to decrease. With options on spot-traded BTC ETFs on the horizon, liquidity is set to expand further. Bitcoin’s market cap could grow to $7.4 trillion if it taps into 1% of the $749.2 trillion market pool. Ultimately, Bitcoin represents a return to sound money amidst central bank erosion of confidence in traditional currencies.

Key Points

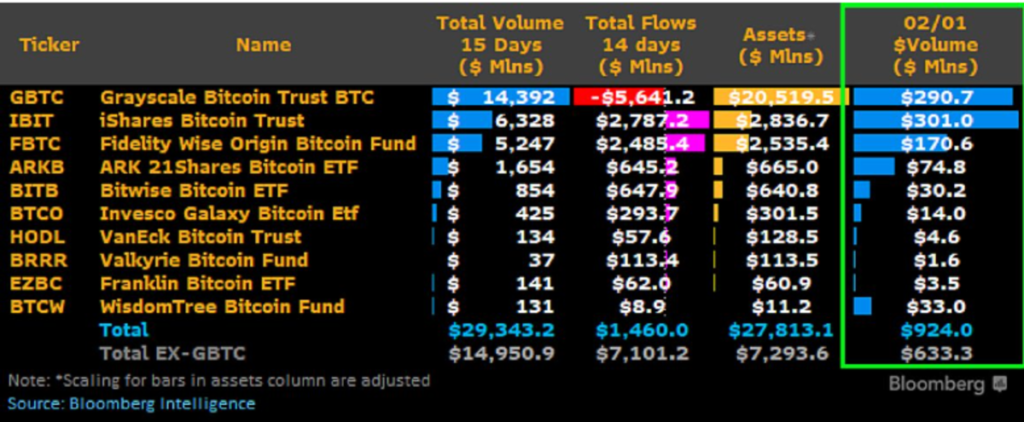

1. Eleven approved Bitcoin ETFs have added legitimacy to the cryptocurrency, removing institutional investing barriers and allowing various entities to access Bitcoin exposure without direct custodianship.

2. Following a period of crypto bankruptcies in 2022, Bitcoin’s price dropped but slowly recovered throughout 2023, reaching $45k by the start of 2024. The introduction of Bitcoin ETFs has helped stabilize Bitcoin’s price volatility.

3. Bitcoin ETFs have demonstrated high demand for a decentralized asset like Bitcoin, with significant trading volumes and inflows into ETFs. The introduction of options on BTC ETFs, pending SEC approval, is expected to further increase liquidity and stabilize market volatility.